The UK’s Chancellor, Jeremy Hunt, recently announced a significant shift in vaping regulation—a new vape tax on vaping products set to take effect in October 2026. This move, announced alongside an increase in tobacco duty, is strategically designed to maintain the cost incentive for choosing to vape over smoking, highlighting the government’s dual focus on public health and smoking cessation efforts.

Current Taxation and Appeal to Youth:

Currently, vaping products attract a standard 20% VAT, except for e-cigarettes regulated as medicines, which are taxed at a lower rate of 5%. This tax structure has raised concerns among officials that the affordability of vaping products could increase their attractiveness to young people and non-smokers, groups not traditionally targeted by nicotine product marketing.

Vaping Tax Details:

To address public health concerns, Chancellor Jeremy Hunt’s budget introduces a detailed, structured tax regime for vaping liquids, segmented into three categories based on nicotine content. This tiered system—comprising rates of £1 for nicotine-free, £2 for standard nicotine, and £3 for high nicotine products per 10ml—is specifically aimed at UK manufacturers and importers.

Introducing this differentiated tax scheme seeks to moderate the market, mainly aiming to reduce vaping’s appeal to younger audiences by adjusting the “pocket money” pricing model. The implications of this new tax structure are considerable, with the potential to double the retail price of high-nicotine products and generate an estimated £500m in revenue by the 2028-29 financial year.

Impact on Larger Vape Liquid Bottles:

The proposed tax structure also significantly changes the pricing of larger e-liquid bottles, a staple in the UK vape industry. For instance, a 100ml e-liquid that currently retails for £15 would see its price increase to £25 to maintain the same margin for the retailer. Additionally, when you consider the addition of 2 x nicotine shots (previously sold at £1.50 each), the total cost to the end consumer could escalate to £34.

There is already much talk of ways to circumvent the vape tax, and one such product that keeps arising is the Long-fill. We will discuss this in greater detail in an upcoming blog post.

Support, Enforcement, and Revenue Allocation:

The tax initiative has garnered support from various sectors, including the Local Government Association and the Chartered Trading Standards Institute. This support highlights the broader benefits of the policy, such as its potential to deter underage vaping and clamp down on the illicit vape market. The government’s commitment to this cause is further underscored by the allocation of £30m in funding to support enforcement agencies from April onwards.

Voices of Disapproval: Consumer and Industry Backlash Against the Vape Tax

While the introduction of a vape tax by Chancellor Jeremy Hunt has been positioned as a measure to balance public health concerns with the financial incentives for choosing vaping over smoking, it has not been met with universal acclaim. A notable chorus of disapproval is emerging, particularly from consumers who are beginning to voice their discontent upon facing the increased costs at checkout. This backlash is not merely about the immediate financial pinch; it’s a broader concern over accessibility to what many consider a vital tool in their journey away from traditional tobacco products.

Consumer Concerns:

The prospect of paying more due to the vape tax is sparking significant unease among vaping enthusiasts and those who have switched from smoking to vaping. For many, the appeal of vaping is not only lies in its potential health benefits over smoking but also its cost-effectiveness. Consumers argue that the tax, which only becomes tangible at the point of sale, could undermine one of the critical advantages of vaping. The delay between the policy announcement and the actual financial impact means that many consumers might only fully grasp the implications once they are directly affected, potentially leading to dissatisfaction across the vaping community.

Industry and Advocacy Group Opposition:

The vape industry, including manufacturers, retailers, and trade organisations, is also rallying against the proposed tax. Leading the charge are prominent groups such as the UK Vaping Industry Association (UKVIA), the Independent British Vape Trade Association (IBVTA), and the newly established Our Vape Advocacy (OVA). These organisations, representing a broad spectrum of the vaping sector, from large companies to small shops, share a unified stance against the tax, citing concerns over its impact on the industry’s sustainability and the potential to drive consumers back to smoking.

OVA: A New Advocate on the Scene:

Our Vape Advocacy (OVA) stands out as a pivotal non-profit organisation conceived out of an urgent need to safeguard the vaping industry’s future. As an entity created by the industry, for the industry, OVA spearheads the effort to foster unity and collaboration, aiming for the betterment and sustainability of the vaping sector. The organisation is committed to representing a collective voice, articulating, and defending the interests of both businesses and consumers against challenges that threaten the industry’s integrity and its contribution to public health.

OVA’s Mission and Goals:

OVA has outlined three core, achievable objectives that reflect its dedication to the industry’s welfare and societal health benefits:

- Combatting Illicit Products: OVA is at the forefront of addressing the influx of unauthorised products, championing the principle that if a product is not suitable for retail sale, it should not be permitted for import. This goal underscores a commitment to maintaining high standards within the industry and protecting consumers from potentially harmful alternatives.

- Addressing Underage Vaping: Another critical mission is to curb the prevalence of vaping among minors. OVA is dedicated to implementing strategies and initiatives that deter underage individuals from accessing vaping products, ensuring that vaping remains a responsible choice for adult smokers seeking safer alternatives.

- Enforcement Collaboration: OVA actively works alongside relevant authorities, including HMRC and Trading Standards, to bolster enforcement efforts. This collaboration aims to ensure compliance with regulations, safeguard the industry’s reputation, and contribute to public health objectives.

Beyond these immediate goals, OVA is also focused on developing a fair and effective Duty/Tax scheme within the UK, advocating for policies supporting the industry’s growth while protecting public health. Additionally, OVA is poised to tackle the challenges posed by potential flavour restrictions, recognising the critical role flavours play in making vaping an attractive option for adult smokers looking to transition away from combustible tobacco.

In essence, Our Vape Advocacy embodies the resilience and forward-thinking approach of the vaping industry, striving to ensure its longevity and positive impact on society’s health. Through its concerted efforts, OVA is paving the way for a regulatory environment that balances the industry’s needs with the goal of achieving a smoke-free generation.

International Context and Comparative Measures:

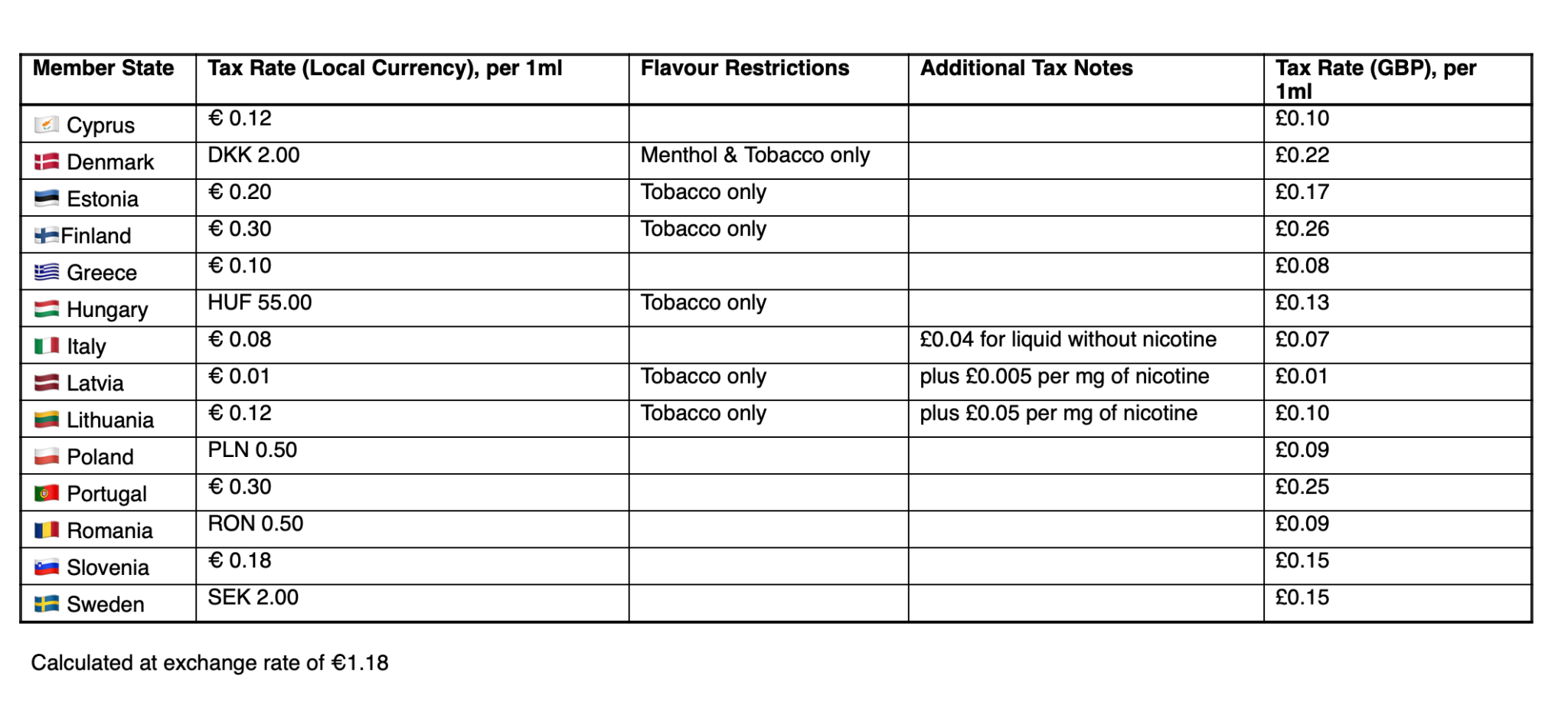

The UK’s collaborative approach mirrors vaping taxation frameworks in several European countries, such as Germany and Italy. With similar schemes already in place across Europe and plans for an EU-wide vaping levy, the UK’s policy aligns with a growing international trend towards regulating vaping through fiscal measures. This global perspective offers valuable insights into the potential outcomes and challenges of implementing a vape tax in the UK.

Conclusion:

In the wake of Jeremy Hunt’s proposal for a vape tax, our stance is one of concern and caution. We view the taxation of vaping products as premature, fearing it strays from the ultimate ambition of cultivating a smoke-free generation and enhancing public health. Our apprehension lies in the magnitude of this tax, which we believe may inadvertently nudge current vapers back towards smoking—a counterproductive shift that undermines years of progress in smoking cessation efforts.

Moreover, looming over the vaping community and an even more significant concern is the potential for a flavour ban, a subject we plan to delve into in another discussion. This prospective ban compounds our worries, signalling what could be a devastating blow to the UK’s vaping industry and, paradoxically, a rise in the number of smokers. The vape tax and the feared flavour ban could significantly derail the path to a healthier society, highlighting the need for a more nuanced approach to vaping regulation.